The CT-1120 form is Connecticut’s Corporation Business Tax Return‚ updated for 2022․ It outlines tax filing requirements‚ compliance guidelines‚ and key deadlines․ Access instructions on the Connecticut Department of Revenue Services website for accurate submission by the required deadline․

Overview of the CT-1120 Form

The CT-1120 form is Connecticut’s Corporation Business Tax Return‚ used by corporations to report income‚ calculate taxes‚ and claim credits or deductions․ It requires detailed financial data‚ including federal tax returns and schedules․ The form must be filed electronically‚ with deadlines varying based on tax year and extensions․ Proper documentation and accurate completion are essential to ensure compliance with Connecticut tax laws and avoid penalties․

Importance of Following the 2022 Instructions

Adhering to the 2022 CT-1120 instructions ensures accurate tax reporting‚ compliance with legal requirements‚ and avoidance of penalties․ Properly following guidelines prevents errors in income calculation‚ deduction claims‚ and credit applications․ Timely submission and correct form completion are crucial for maintaining good standing with Connecticut tax authorities and optimizing tax liability․

General Instructions for Filing CT-1120

Gather all financial documents‚ complete each form section accurately‚ and understand the filing process․ Failure to follow instructions may result in penalties or delays․ Refer to official guidelines for compliance․

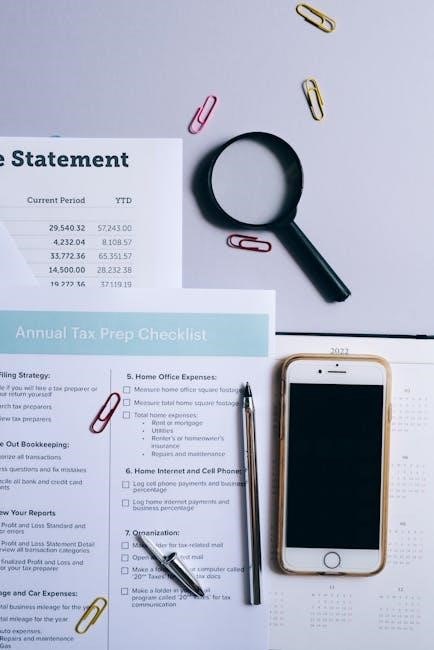

Gathering Necessary Financial Documentation

Collect all financial records‚ including federal tax returns‚ profit and loss statements‚ and balance sheets․ Ensure accuracy by cross-referencing with bank statements and ledgers․ Organize documents to streamline form completion and avoid errors․ Attachments like Schedule H and Schedule C must be included․ Proper documentation supports accurate tax calculations and compliance with Connecticut tax laws․

Completing Each Section of the Form Accurately

Ensure all fields in Form CT-1120 are filled precisely‚ referencing federal tax returns and financial records․ Review Schedule C for income details and Schedule H for apportionment calculations․ Verify mathematical accuracy and adherence to Connecticut tax laws․ Avoid errors in reporting net income‚ deductions‚ and credits․ Double-check federal adjustments and apportionment formulas to ensure compliance and prevent delays in processing․

Understanding the Filing Process

Filing the CT-1120 involves submitting the completed form with attachments like federal returns and schedules․ Electronic filing is mandatory for all corporations‚ ensuring timely and secure submission․ Pay any tax due through the online portal․ If amending‚ use Form CT-1120X and attach necessary documents․ Confirm receipt of submission for accuracy and avoid penalties․ Ensure compliance with all Connecticut tax regulations and deadlines for a smooth process․

Filing Requirements and Deadlines

The CT-1120 must be filed annually‚ with deadlines varying based on tax year and extensions․ Electronic filing is mandatory‚ and payments must accompany submissions to avoid penalties․

Timeline for Submitting the CT-1120 Form

The CT-1120 form is due by the 15th day of the 4th month following the close of the tax year‚ typically April 15th for calendar-year corporations․ A six-month extension is available using Form CT-1120 EXT․ Electronic filing is mandatory‚ and the final payment must accompany the return by the extended deadline to avoid penalties and interest․

Consequences of Missing Deadlines

Missing the CT-1120 filing deadline results in penalty fees and interest on unpaid taxes․ Late submissions may also lead to the loss of carryover losses․ Overpayments applied to the next year’s tax are forfeited if the current year’s return is not filed timely․ Late filing complicates future tax calculations and compliance‚ emphasizing the importance of adhering to deadlines to avoid financial and administrative penalties․

Electronic Filing Requirements

All corporations must file and pay electronically using approved platforms․ Paper filings are not accepted․ Ensure accurate submission of Form CT-1120 and related schedules through designated e-file systems․ Late or incomplete electronic submissions may result in penalties․ Use Form CT-1120 EXT for extensions if needed․ Visit the Connecticut Department of Revenue Services website for detailed e-filing guidelines and to avoid processing delays or additional fees․

Calculating Income and Deductions

Accurate calculation of net income and allowable deductions is crucial for compliance․ Ensure all figures align with federal returns and adhere to Connecticut’s apportionment rules and special considerations․

Reporting Net Income

Net income must be reported accurately on Form CT-1120․ It should reflect federal taxable income‚ adjusted for state-specific modifications․ Ensure compliance with Connecticut’s tax laws and include all necessary documentation․ Properly apportion income for multistate businesses․ Accurate reporting ensures correct tax liability calculation and avoids potential penalties․ Always refer to the latest instructions for updated guidelines and exclusions․

Claiming Allowable Deductions

Claim allowable deductions on Form CT-1120 by following state-specific guidelines․ Ensure all deductions align with Connecticut tax laws․ Attach supporting documentation for each deduction claimed․ Special deductions‚ such as those for captive REITs‚ require proper identification and inclusion of the FEIN․ Rounding adjustments and federal form attachments are mandatory․ Accurate reporting ensures compliance and minimizes audit risks․ Always verify eligibility before claiming deductions․

Special Considerations for Apportionment

Apportionment requires careful calculation of income sourced to Connecticut․ Multistate businesses must adhere to Connecticut-specific rules․ Ensure accurate reporting of apportioned income‚ considering interstate transactions․ Special cases‚ such as unitary affiliates‚ may require adjustments․ Consult the CT-1120 instructions for detailed apportionment guidelines․ Proper documentation and compliance with state rules are essential to avoid discrepancies․ Seek professional assistance if complexities arise to ensure accurate reporting․

Apportionment and Allocation

Connecticut-specific apportionment rules govern income allocation for multistate businesses․ Ensure accurate allocation and compliance with state regulations to avoid discrepancies․ Proper documentation is essential for precise reporting․

Connecticut-Specific Apportionment Rules

Connecticut applies a three-factor apportionment formula to allocate income for multistate businesses․ The formula considers property‚ payroll‚ and sales‚ with sales weighted at 50%․ Businesses must accurately calculate their Connecticut apportionment percentage by averaging these factors․ Proper documentation is required to ensure compliance with state tax regulations and avoid discrepancies in reporting․ This method ensures fair income allocation for tax purposes․

Interstate and International Considerations

Connecticut applies a three-factor apportionment formula for interstate businesses‚ weighting property‚ payroll‚ and sales (with sales weighted at 50%)․ For international operations‚ foreign income is generally not subject to Connecticut tax‚ but proper allocation and apportionment of income are required to avoid double taxation․ Businesses must ensure compliance with state and federal regulations to maintain accurate tax reporting and avoid discrepancies․

Special Cases for Multistate Businesses

Multistate businesses must adhere to Connecticut’s specific apportionment rules‚ ensuring accurate allocation of income․ Unitary groups may file as a single entity using Form CT-1120CU‚ simplifying reporting․ Special considerations apply to industries like manufacturing and services‚ requiring detailed documentation․ Businesses must comply with nexus definitions to avoid over-reporting or under-reporting income‚ ensuring tax obligations align with state regulations and minimizing audit risks․

Tax Credits and Incentives

Connecticut offers various tax credits to reduce corporate tax liability‚ such as Research and Development credits․ These incentives encourage business growth and innovation‚ with detailed claiming instructions provided in the 2022 CT-1120 guidelines․

Available Tax Credits for 2022

For the 2022 tax year‚ corporations can claim various tax credits to reduce their liability․ Key credits include the Research and Development (R&D) Tax Credit‚ promoting innovation‚ and the Pass-Through Entity Tax Credit․ Additionally‚ Connecticut offers incentives for certain industries and initiatives․ These credits are detailed in the 2022 CT-1120 instructions‚ ensuring businesses can maximize their tax savings․ Visit the Connecticut Department of Revenue Services (DRS) website for eligibility criteria and filing requirements․

Research and Development Tax Credits

The Research and Development (R&D) Tax Credit incentivizes innovation by allowing corporations to claim qualified research expenses․ Eligible activities include software development‚ product design‚ and process improvements․ Expenses such as wages‚ supplies‚ and contract costs may qualify․ This credit reduces tax liability for businesses investing in innovation․ Refer to the 2022 CT-1120 instructions for detailed eligibility and calculation guidelines to ensure compliance and maximize benefits․

How to Claim Credits on the CT-1120

To claim tax credits on the CT-1120‚ identify applicable credits and complete the required schedules․ Calculate the credit percentage as specified in the instructions and report the credit on the designated line․ Attach supporting documentation‚ such as Form CT-1120K‚ to validate the claim․ Ensure all calculations align with Connecticut tax regulations for accurate processing and compliance․ Proper documentation is essential to avoid delays or discrepancies․

Estimated Tax Payments

Understand your estimated tax liability and payment schedules to ensure timely compliance․ Adjust payments based on income fluctuations and refer to Form CT-1120 instructions for guidance․

Understanding Estimated Tax Liability

Calculate your estimated tax liability based on current income and deductions․ Use Form CT-1120AE for annualizing income and determining quarterly payments․ Ensure timely payments to avoid penalties․ Overpayments can be applied to the next year’s tax․ Refer to the CT-1120 instructions for guidance on payment schedules and required documentation to maintain compliance with Connecticut tax regulations․

Payment Schedules and Due Dates

Estimated tax payments for Connecticut corporations are due in four installments․ The first installment is due by April 15th of the current year‚ with subsequent payments due on June 15th‚ September 15th‚ and January 15th of the following year․ Use Form CT-1120ES to make payments․ Ensure timely filing to avoid penalties․ Overpayments can be applied to the next year’s tax․ File electronically for accuracy and compliance․

Adjusting Payments Based on Income

Corporations may adjust estimated tax payments based on changes in income during the year․ Use Form CT-1120ES to recalculate installments․ Annual reconciliation ensures accuracy‚ avoiding underpayment penalties․ Adjustments must reflect current financial projections‚ with overpayments applied to the next year’s tax․ Ensure timely filing to maintain compliance and avoid additional fees․ Monitor income fluctuations to make precise payment adjustments․

Extensions and Amended Returns

Use Form CT-1120 EXT to request a six-month extension for filing․ File amended returns using Form CT-1120 if federal changes impact state taxes․ Attach required documents․

Requesting an Extension

To request an extension for filing Form CT-1120‚ use Form CT-1120 EXT․ This form grants a six-month extension and must be mailed to the Connecticut Department of Revenue Services․ Include the completed application and supporting documents․ The extension does not extend the time for payment of any tax due․ Overpayments from 2022 may be applied to 2023 estimated tax if the return is filed timely․

Filing an Amended Return

To file an amended return‚ use Form CT-1120 and check the Amended box on Page 4․ Attach a copy of federal Form 1120X if applicable and address to the Connecticut Department of Revenue Services․ Amended returns must be filed within 90 days of the IRS final determination for federal amendments affecting state tax․ Ensure all supporting documents are included to avoid delays in processing․

Handling Overpayments and Refunds

Overpayments on CT-1120 can be applied to the next year’s estimated tax or refunded․ To request a refund‚ file Form CT-1120 and check the appropriate box․ Ensure timely submission to avoid delays․ Refunds are processed after the return is reviewed․ For details‚ refer to the Connecticut Department of Revenue Services guidance and instructions provided with the form․

Special Filing Situations

Special filing situations include S corporations‚ pass-through entities‚ and withdrawal from Connecticut operations․ Each requires unique documentation and adherence to specific state regulations for accurate tax reporting․

Filing for S Corporations

Filing for S corporations requires electing S Corp status and reporting income‚ deductions‚ and credits․ Attach a completed federal income tax return‚ including schedules‚ to Form CT-1120․ Ensure compliance with Connecticut-specific rules for pass-through entities and special deductions․ Amended returns must be filed within 90 days of IRS final determination․ Proper documentation and adherence to state regulations are essential for accurate tax reporting and avoiding penalties․

Pass-Through Entities and Their Requirements

Pass-through entities must file Form CT-1120SI and report distributive shares․ Ensure accurate completion of Schedule CT-1065 and attach federal returns․ Note Connecticut-specific apportionment rules and deductions․ Timely filing and payment of estimated taxes are required‚ with extensions available using Form CT-1120 EXT․ Proper documentation and adherence to state guidelines are crucial for compliance and avoiding penalties․

Withdrawing from Connecticut Operations

Corporations withdrawing from Connecticut must file Form CT-1120 up to the withdrawal date․ Include all income and pay taxes due․ Attach federal returns and submit necessary documentation․ Ensure compliance with state regulations and deadlines to avoid penalties․ Final payments must be made electronically‚ and any overpayments may be applied to future estimated taxes․ Proper filing ensures a smooth transition out of Connecticut operations․

Compliance and Audits

Maintain accurate records and documentation to ensure compliance with Connecticut tax laws․ Understand audit triggers and respond promptly to notices to avoid penalties and ensure a smooth process․

Maintaining Proper Documentation

Accurate record-keeping is crucial for compliance with Connecticut tax laws․ Retain all financial statements‚ receipts‚ and federal tax returns for at least three years․ Ensure documentation supports all income‚ deductions‚ and credits claimed on Form CT-1120․ Maintain copies of federal Form 1120 and related schedules‚ as well as any state-specific attachments․ Proper documentation helps prevent audit issues and ensures timely resolution of any discrepancies․

Understanding Audit Triggers

Several factors can trigger a Connecticut tax audit‚ including significant discrepancies between federal and state returns․ Incomplete or inaccurate reporting on Form CT-1120 may also raise red flags․ Additionally‚ unusually high deductions relative to income or failure to file required schedules can prompt an audit․ Ensure all submissions align with federal adjustments and maintain thorough documentation to address potential issues efficiently․

Responding to Audit Notices

Upon receiving a Connecticut audit notice‚ review the details carefully․ Respond promptly by the specified deadline‚ providing all requested documentation․ Ensure accuracy in submitted records and consider consulting a tax professional․ If discrepancies are found‚ address them cooperatively․ Maintain clear communication with the Connecticut Department of Revenue Services to resolve the audit efficiently and avoid penalties․

Additional Resources

Access detailed guidance from the Connecticut Department of Revenue Services website․ Utilize professional tax assistance for complex filings․ Leverage online tools‚ PDF guides‚ and worksheets for accurate submission․

Connecticut Department of Revenue Services Guidance

The Connecticut Department of Revenue Services (DRS) provides comprehensive guidance for the CT-1120 form․ Visit their official website for detailed instructions‚ downloadable forms‚ and schedules․ The DRS also offers webinars‚ informational publications‚ and FAQs to assist with accurate tax filing; Additionally‚ they provide resources for understanding apportionment‚ tax credits‚ and compliance requirements specific to Connecticut corporate taxes in 2022․

Professional Assistance Options

Consulting tax professionals or legal experts is recommended for complex CT-1120 filings; They provide tailored advice on deductions‚ apportionment‚ and compliance․ Additionally‚ enrolled agents and certified public accountants can assist with audits and amended returns‚ ensuring accuracy and adherence to Connecticut’s 2022 tax regulations․ Their expertise minimizes errors and optimizes tax efficiency․

Online Tools and Worksheets

The Connecticut Department of Revenue Services offers online tools and worksheets to simplify the CT-1120 filing process․ Access downloadable PDF forms‚ interactive calculators‚ and instructional guides on their website․ These resources help with accurate form completion‚ tax credit calculations‚ and compliance with 2022 regulations․ Utilize tools like the Apportionment Worksheet and Tax Credit Calculator for precise submissions and adherence to state tax requirements․